As the World’s #1 ESG Software for Commercial Real Estate, Measurabl has stayed on top of regulations, and our customers can rely on our centralized ESG data platform to keep them ahead of regulations and successfully meet the proposed SEC climate disclosure regulations.

The new regulations proposed by the Security and Exchange Commission (SEC) will significantly impact publicly traded real estate companies, but Measurabl customers already have been prepared, as our platform allows them to track and measure required metrics like Total, Scope 1, and Scope 2 emissions along with total renewable usage.

The proposed disclosure requirements include:

- Risks. How any climate-related risks have had or are reasonably likely to have material impacts on a company’s business or consolidated financial statements.

- Impact on the company. How any climate-related risks have affected or are reasonably likely to affect a company’s strategy, business model and outlook.

- Risk management/oversight process. Processes for identifying, assessing and managing climate-related risks, as well as board governance of climate-related risks and relevant risk management processes.

- GHG emissions. Greenhouse gas (“GHG”) emissions metrics, which would include:

- Scope 1 and Scope 2, which, for accelerated and large accelerated filers only, would be subject to assurance by an independent GHG emissions attestation provider.

- Targets/goals. Information regarding climate-related targets, goals, and transition plans, if any.

Our current features are actively helping customers automate ESG reporting and stay ahead of SEC climate disclosure regulations:

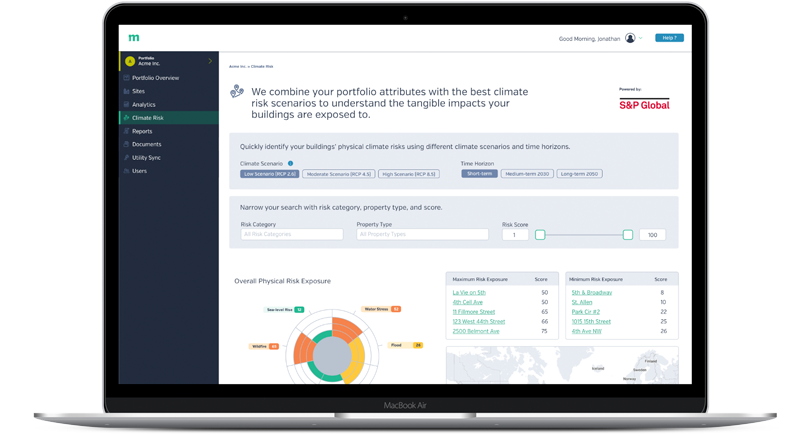

- Monitoring and mitigating climate risk. Measurabl’s Physical Climate Risk Exposure (PCRX) integrates global physical climate risk data into our ESG platform to help customers understand their risks. Thanks to an additional integration with S&P Global, PCRX customers can view physical climate risks affecting their assets across three climate scenarios, three time frames, and seven risk categories.

- Tracking progress toward targets. Measurabl enables users to set and track carbon emissions, energy, water, and waste diversion targets so they can easily report progress to investors and regulators.

- Reporting investment grade data on demand. Automating utility data and removing the human error associated with manual processes was just the beginning. Along the way we have instituted automated data checks, data completeness, data assurance, and other features that give customers access to information that is truly investment grade. Customers can export this data on demand in multiple formats, giving them the flexibility to report to multiple frameworks.

- Acting on climate risk data. Measurabl’s Climate Resilience Services, gives customers the option to connect with climate risk experts to help them leverage data from PCRX, determine the costs of those risks, and provide personalized recommendations and estimated costs of risk mitigation projects, such as flood barriers and green roofs.

Throughout this year and beyond, Measurabl will continue to introduce new features designed to help customers act on ESG data and decarbonize their portfolios, completing our vision of a truly meter to market solution. Measurabl was founded on the idea that readily accessible ESG data on material indicators like carbon emissions and physical climate risk can create a more sustainable built environment. Our customers are well positioned to meet the proposed SEC regulations head on, and we look forward to finding even more ways to help the real estate industry report and act on building- and portfolio-level emissions and climate risk data.