All buildings are exposed to some level of physical climate risk, and these impacts will intensify with our changing climate. That’s why Measurabl has integrated global physical climate risk data into our ESG platform to help our customers understand their risks.

The first step to improve your portfolio’s resilience is to gather data about assets so you can understand their level of exposure. Until now, the commercial real estate sector has largely relied upon property insurance policies to determine their portfolio’s level of risk. But insurance companies often rely on historical data about an area to assess risk, rather than examining climate trends that can identify regions vulnerable to future catastrophes.

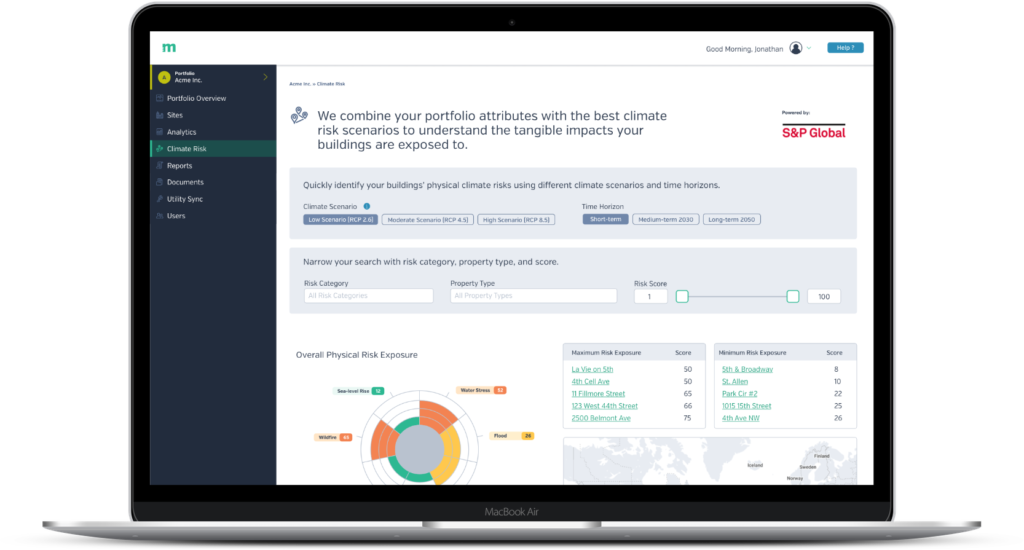

Measurabl customers can now view physical climate risks affecting their assets across three climate scenarios, three time frames, and seven risk categories thanks to data from partner S&P Global.

Having access to granular physical climate risk data alongside their existing ESG data in Measurabl makes it easier for building owners and managers to comply with regulations and frameworks. For example, climate risk data covering multiple climate scenarios is critical for real estate companies to align with one of 11 Task Force on Climate-Related Financial Disclosures (TCFD) recommendations.

Read: Physical Climate Risk: What it Means for Real Estate Owners and Investors

Asset-Level Risk Management

Measurabl’s PCRX feature provides CRE owners and investors instant access to physical climate risk information about their portfolios in the same place as their ESG performance data. By entering the locations of their buildings, customers can instantly view their level of exposure to several risk factors including water stress, extreme hot and cold temperatures, hurricanes, wildfires, and sea level rise. With this knowledge, our customers are empowered to mitigate effects of their portfolio’s physical environments and identify opportunities.

PCRX pulls in data that identifies a building’s physical climate risk and assigns a percentile score compared with climate risk data from nearly all areas of the Earth where commerce is done.

Now That I Know My Risk, What’s Next?

Knowledge is power: When real estate companies take charge of their own asset-level data, they can better diversify their investments—for example, building in low-risk areas to balance out high-risk investments. They can also assign value to projects that make their buildings more resilient. In addition to retrofit projects, resilience can be incorporated in building design and construction—and not just in areas currently deemed high-risk.

No matter what actions you decide to take, having a clear, seamless way to collect, analyze, and report resilience data will go a long way in ensuring access to capital and preparing your business to thrive in an increasingly unstable climate.

Measurabl customers can contact their dedicated customer service managers to learn more about this feature.

Schedule a demo with our team to see PCRX and other Measurabl features in action.

Get Expert Guidance

Measurabl now provides customers who have opted into PCRX a path to act on their buildings’ specific physical climate risks. Measurabl’s Climate Resilience Services enable customers to determine their buildings’ detailed climate risks, the estimated costs of those risks, and recommendations and costs for mitigating those risks.

Customers interested in high-level risk reporting can get a desktop report that is prepared remotely, while customers interested in implementing mitigation projects can get a more in-depth report prepared after a site visit from building professionals. Interested in learning more? Ask about our Climate Resilience Services today.