“Building climate intelligence is central to value creation and strategic differentiation in the real-estate industry. But the reverse is also true: real estate is central to global climate change mitigation efforts,” say Boland, Levy, Palter, and Stephens of McKinsey. Real estate, unfortunately, drives 40% of total global emissions.

However, prioritizing climate due diligence can help real estate stakeholders transition to a low-carbon economy. Before diving into any real estate transaction, assess the risks and opportunities. This way, you can make better business decisions that improve your buildings’ energy performance and lower the costs associated with retrofitting to meet evolving energy standards.

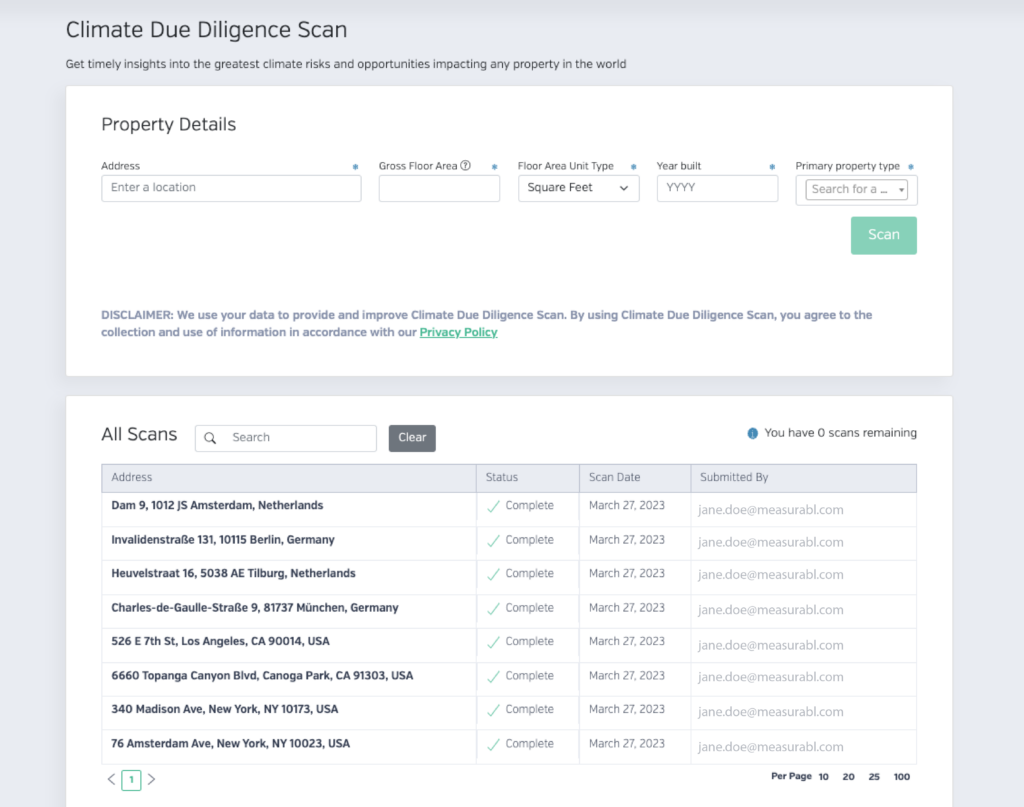

Climate Due Diligence Scan (CDDS), a new product from Measurabl, can help you on this journey. CDDS is an on-demand report designed for property lenders, insurers, and investors in the real estate sector. This scan offers instant visibility into climate-related risks affecting properties for purchase, financing, or insurance purposes.

Unlike other services, this scan delivers an immediate report with climate-relevant data, enabling timely due diligence and risk mitigation for real estate properties. With CDDS, carbon and energy estimates are available for any building in the world, with data from 2018 up to trailing 12 months.’ Energy and carbon benchmarks are provided alongside, enabling the evaluation of projected performance relative to peers.

Climate due diligence plays a crucial role in safeguarding asset value against physical climate risks, among other climate-related threats.

Measurabl’s CDDS was built to help real estate stakeholders assess an asset’s exposure to physical climate hazards; the product ranks physical threats to a building on a scale between one and a hundred, helping identify if the risk to the property is low or high. Knowing possible threats your assets may face makes you better equipped to make sound business decisions.

This blog article is the third in a series on climate due diligence and how to identify opportunities to enhance a property’s resilience. To learn more about how CDDS can help you protect assets against climate-related risks, keep reading.

Carbon Footprint, Energy Performance, and Value Creation: A Correlation

As your portfolio’s carbon emissions are reduced and energy performance improves, the value of your assets will be protected and likely appreciate, especially as property requirements evolve to meet net-zero standards over the next few decades.

Unfortunately, the real estate industry is still far from its 2050 decarbonization goals. The UN found that the real estate sector reached a record high of carbon emissions in 2021, accounting for more than 34% of global energy demand and approximately 37% of energy and process-related CO2 emissions.

“Emissions peak before 2030 across all scenarios, but the decline is insufficient for a 1.5º pathway,” states McKinsey. By 2050, power consumption is expected to triple due to the expansion of electrification and improving living standards.

Here’s the reality: high energy consumption and carbon emissions significantly limit the successful outcome of real estate transactions. For example, future challenges could include the inability to sell or lease a building with a poor environmental rating.

The way toward decarbonization

To counteract emissions, make energy performance top of mind. The global shift towards sustainable buildings presents real estate leaders with two areas of opportunity: retrofitting existing structures and ensuring new construction minimizes emissions.

Although retrofitting can be expensive, the outcome can well be worth the effort. “Retrofitting can be a costly process up front, but upon completion, building owners will start to see immediate savings. With new, streamlined technology, working at optimal performance, owners will more than recover the hefty initial costs,” says RENU Communities Chief Technology Officer, Chris Gray.

The answer to address these challenges is straightforward. “Net-zero builders can create value by investing in next-generation technologies, replacing equipment with low-emissions models, and improving energy efficiency,” say Brodie Boland and Focko Imhorst at McKinsey.

Well, climate due diligence might be the answer to accurately assessing a building’s potential and making investment decisions that move you closer to decarbonization goals.

Measurabl’s CDDS, for instance, offers carbon estimates, along with industry benchmarks, with just a few simple details such as the building’s address, floor area, year built, and property type. With this data, you have a lightweight screening tool that allows you to compare energy performance and make decisions in early stage due diligence to exclude, pursue deeper due diligence, or target high-impact opportunities among your future investments.

Additionally, you’re better equipped to assess potential future costs associated with retrofitting or meeting new environmental standards. In time, as the retrofitting process gains momentum, there’ll be more demand for manufacturers and installers of building materials that promote low emissions and enhance efficiency.

Climate Due Diligence Scan: Empowering Informed Transaction Decisions

To ensure you’re progressing towards your decarbonization goals, evaluate the impact of investments.

For instance, before purchasing a building, you can access energy and emission estimates to guide deeper due diligence and alignment with your sustainability targets and investment strategies. Remember that even financial institutions like banks have committed to net-zero goals and will consider Scope 3 emissions when valuing assets.

Improved energy performance can positively affect asset value in various ways, including lower vacancy rates, reduced depreciation, lower operating expenses, and the potential for higher tenant rents.

How will climate due diligence help? Identify opportunities to enhance a property’s resilience, such as incorporating green infrastructure, implementing energy-efficient measures, or adopting sustainable building practices. Or, you can decide if a property is worth the investment based on whether it meets current energy benchmarks.

For indirect investors, lenders, and insurers, energy and carbon data is generally scarce—until now. CDDS offers insight into a property’s energy performance for early stage due diligence, which wasn’t possible on-demand until recently. With the help of CDDS, real estate stakeholders can identify, prioritize, and plan business decisions based on current climate data and consider potential future outcomes.

“For managers seeking to raise capital, being able to furnish information on ESG factors in alignment with standards and frameworks may allow them to communicate that the information provided in diligence meets the boundaries, assumptions, and judgments expected from an investor,” states Deloitte.

Traditional property-level due diligence services often rely on ad-hoc escalation, consultant engagement, and manual processes, resulting in extended turnaround times and significant expenses.

When you need a property’s ESG data quickly, consider CDDS as a faster, cost-effective screening tool you can use before diving into a more comprehensive evaluation. Within minutes, you’ll get exact energy performance estimates from the world’s largest actual real estate database from more than 1,000 customers in 90+ countries, and over 15 billion square feet of real estate information.

This is the third blog in our series about Measurabl’s Climate Due Diligence Scan. For more about CDDS, check out the rest of the series:

• Navigating Climate Regulations: Measurabl’s Climate Due Diligence Scan for Real Estate Investors and Lenders

• Climate Due Diligence: Assessing Real Estate for Physical Climate Risks

• Tapping Into Sustainability With Green Building Certifications