Measurabl Diligence

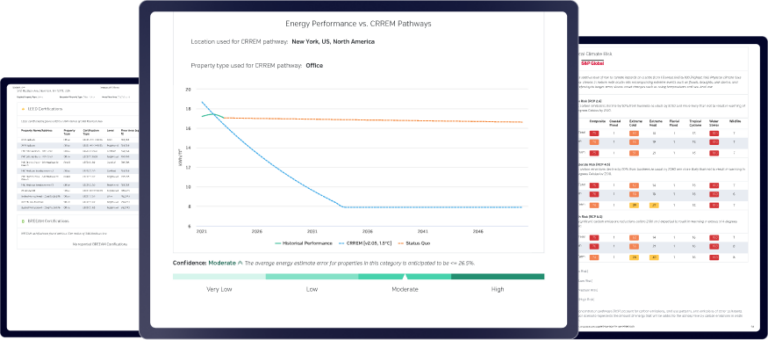

An on-demand real estate climate scan for any property, anywhere in the world.

Due Diligence, Like Never Before

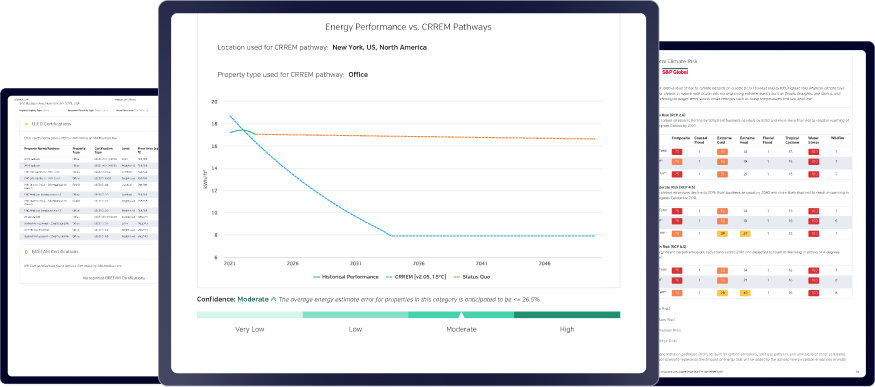

For the first time ever, environmental risks such as energy consumption, carbon emissions, climate hazards, green building certifications, and relevant climate regulations are now easily and instantly accessible.

Simply provide the address, floor area, property type, and year built, and Diligence will uncover comprehensive sustainability risks and opportunities for any building, anywhere in the world—within minutes.

Clear and concise reports simplify complex information, providing the clarity you need when screening new opportunities.

An Insider’s Look at Sustainability Performance

Non-financial risk assessment is now an imperative in the real estate industry and property investors, lenders, and insurers need clear, reliable, and timely property-level sustainability data.

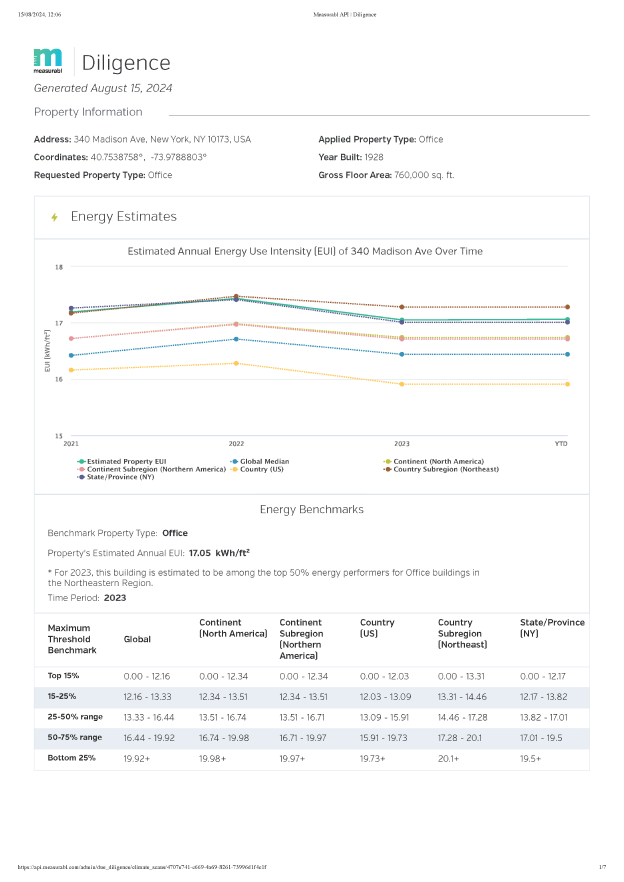

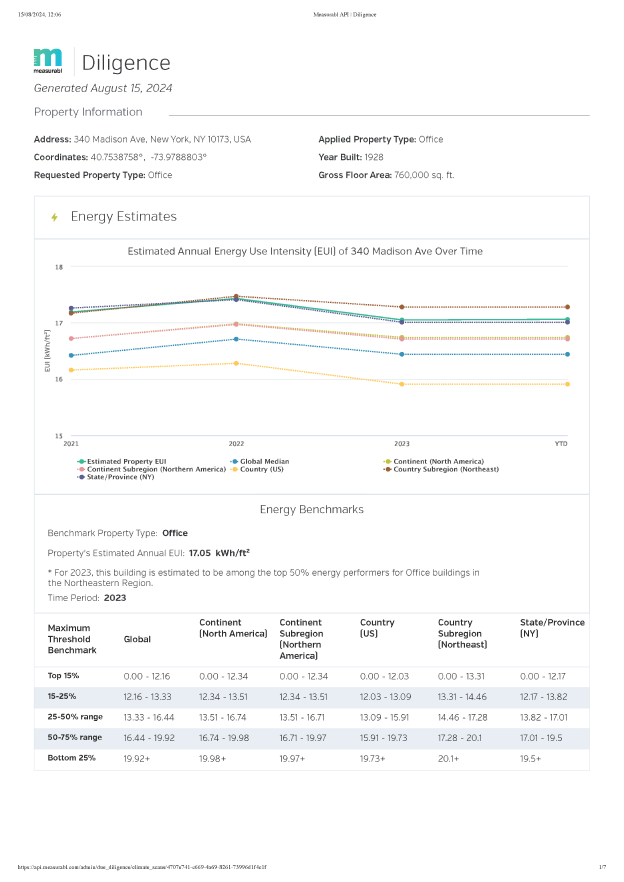

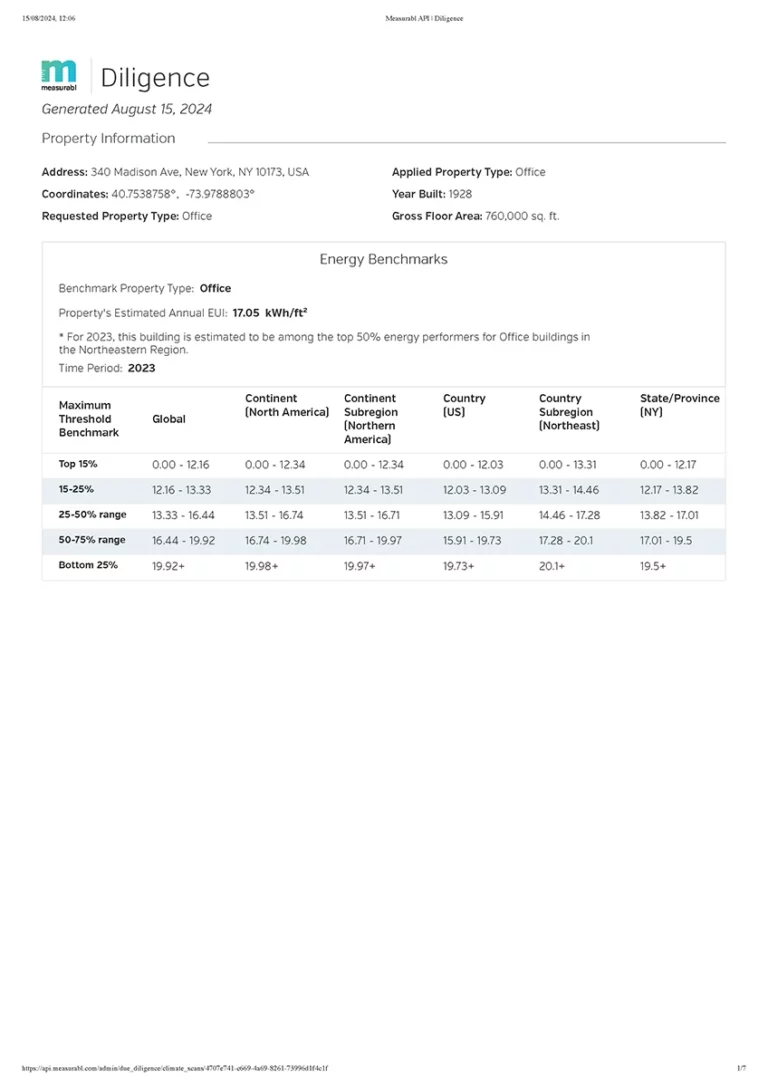

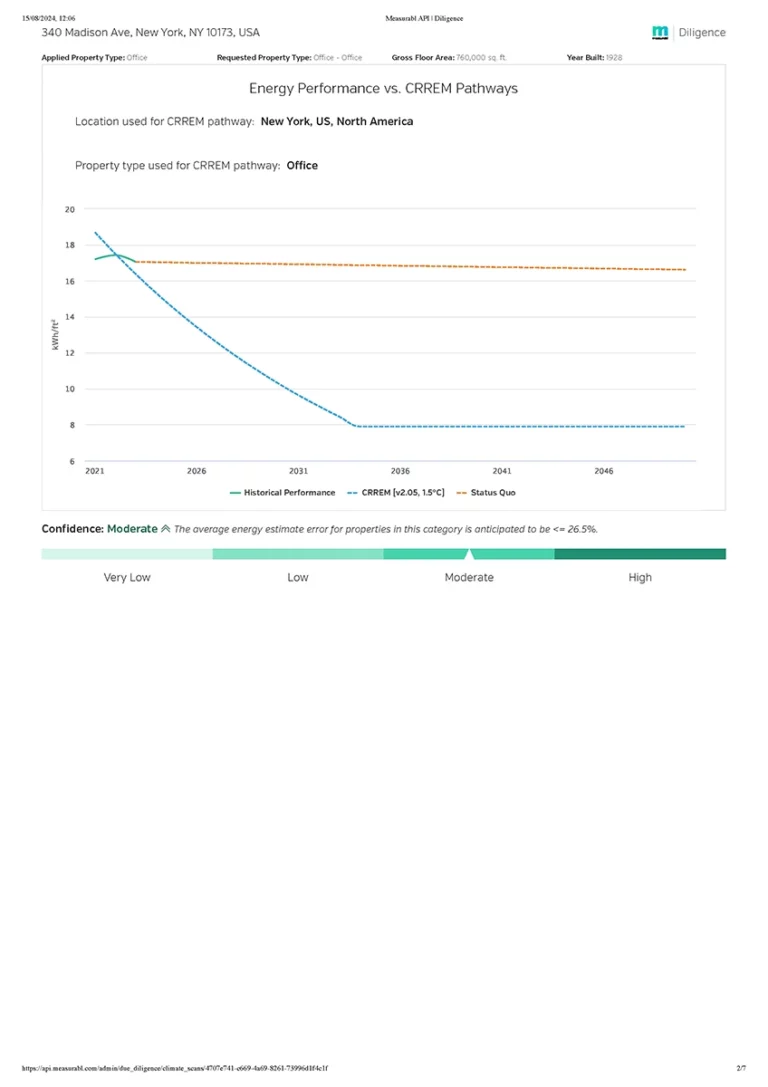

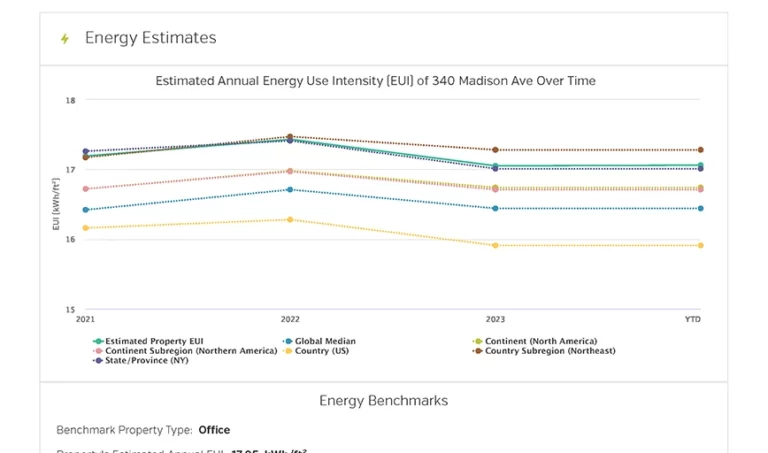

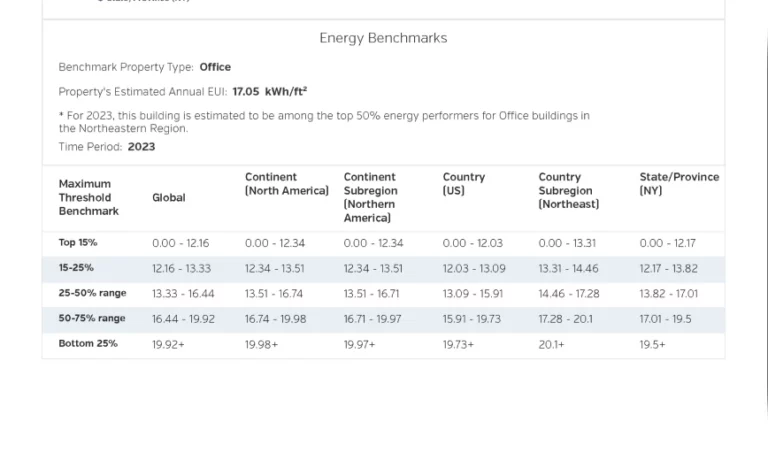

Diligence provides highly accurate energy and carbon estimates using Measurabl’s advanced machine-learning model, backed by over 18 billion square feet of real estate data and S&P Global Sustainable1’s physical climate risk insights.

Everything You Need to Know About a Property

Designed for real estate stakeholders to evaluate an asset’s exposure to physical and transitional climate risks, Diligence helps you make informed decisions by comparing a property’s environmental performance against global, national, and state benchmarks.

Smarter Due Diligence for Real Estate Stakeholders

Diligence helps you:

- Gain financially material climate insights into properties you do not directly own or operate

- Assess whether a property is likely to be accretive or dilutive to your existing carbon footprint

- Determine whether more extensive and expensive building audits and assessments are needed before proceeding

- Incorporate sustainability risks and opportunities into your existing investment and loan committee workflows

Designed for everyone

- Owners and operators completing acquisition due diligence

- Lenders conducting financing due diligence

- Limited partners needing to ensure climate risks are being incorporated by fund managers

Assess climate risk

Most property-level due diligence services are manual, costly, and slow. Diligence can be accessed by anyone to deliver results in minutes, and can be used as a quick pre-screen before a more detailed evaluation.

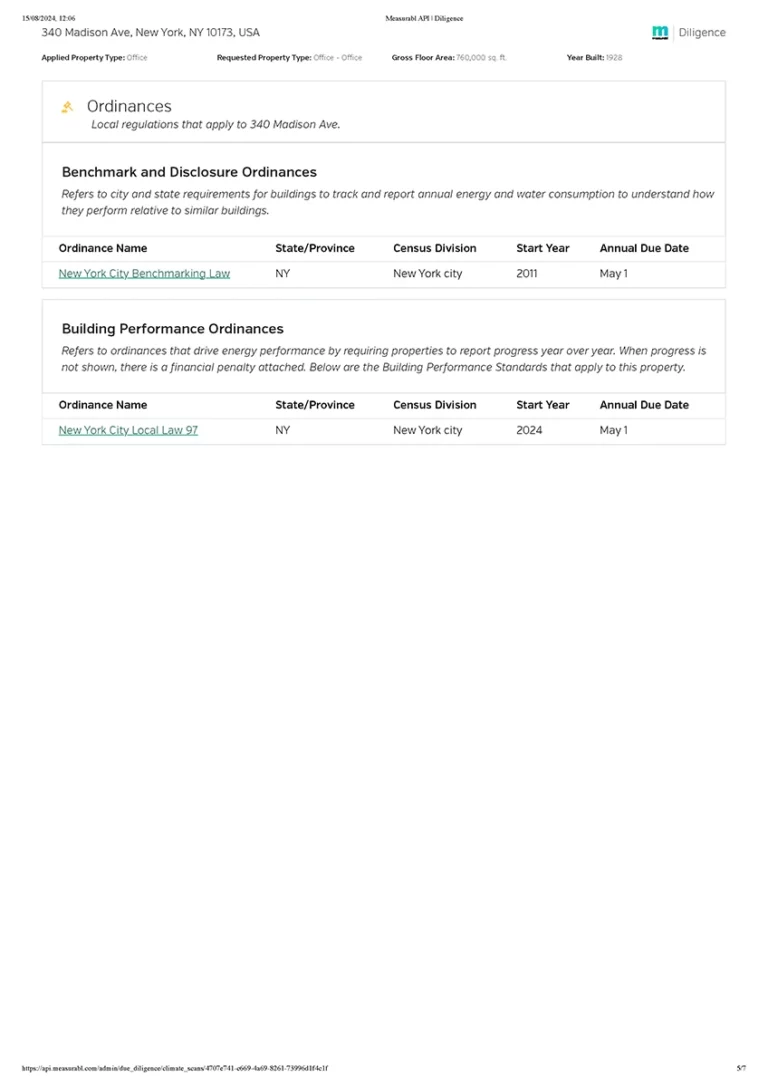

Stay ahead of regulatory compliance

Poor environmental performance can put real estate transactions at risk. Diligence helps you to identify and consider environmental regulations when making investment decisions.

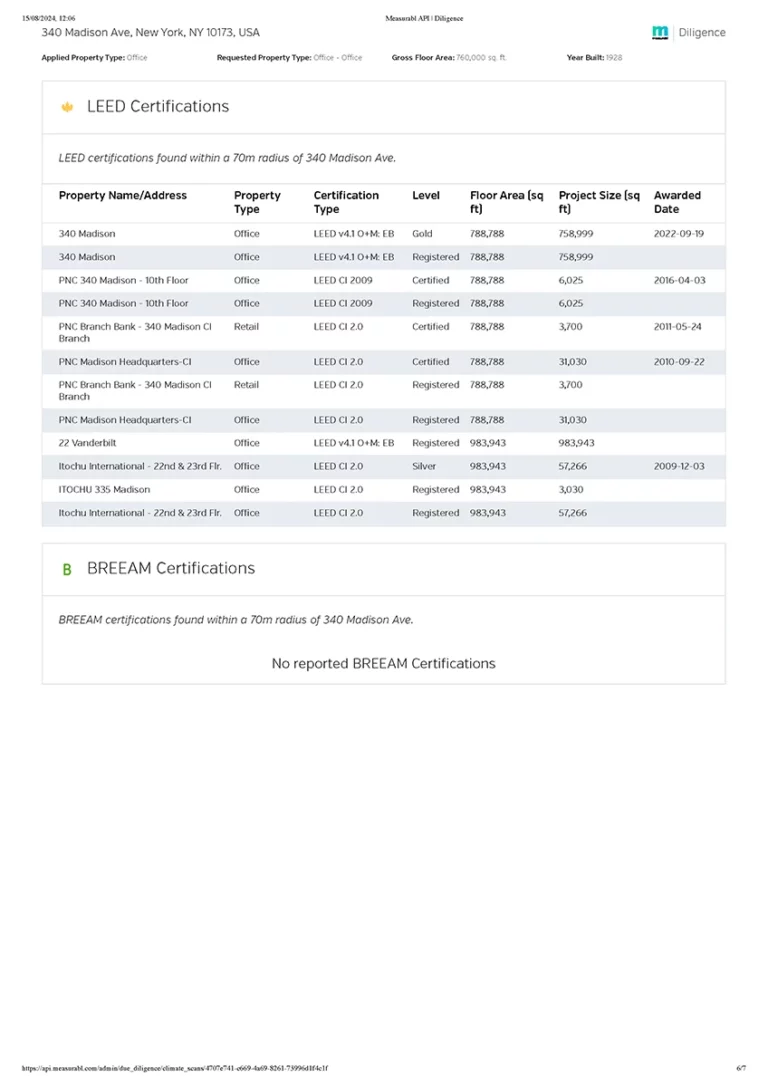

Identify sustainable real estate opportunities

Sustainable real estate helps preserve or increase asset value by reducing vacancy rates, depreciation, and operating costs, while increasing tenant rents. With Diligence, you can quickly screen a property’s sustainability profile, allowing you to make informed decisions.

Get A Free Demo

It’s Time to Rethink Diligence

Effective, efficient due diligence is key for safeguarding financial performance and reputation. By evaluating an asset’s carbon emissions and resource consumption, you uncover opportunities for innovation, product development, and market positioning.

Accurate, timely environmental performance data at scale is essential for markets to price ESG risk into real estate transactions and ultimately build a more effective, efficient market."

Gregory MichaudHead of Real Estate Finance at Voya Investment Management

Proactive climate risk management is crucial for building resilient real estate portfolios.

Get the power of answers. Request a free demo.