VMware

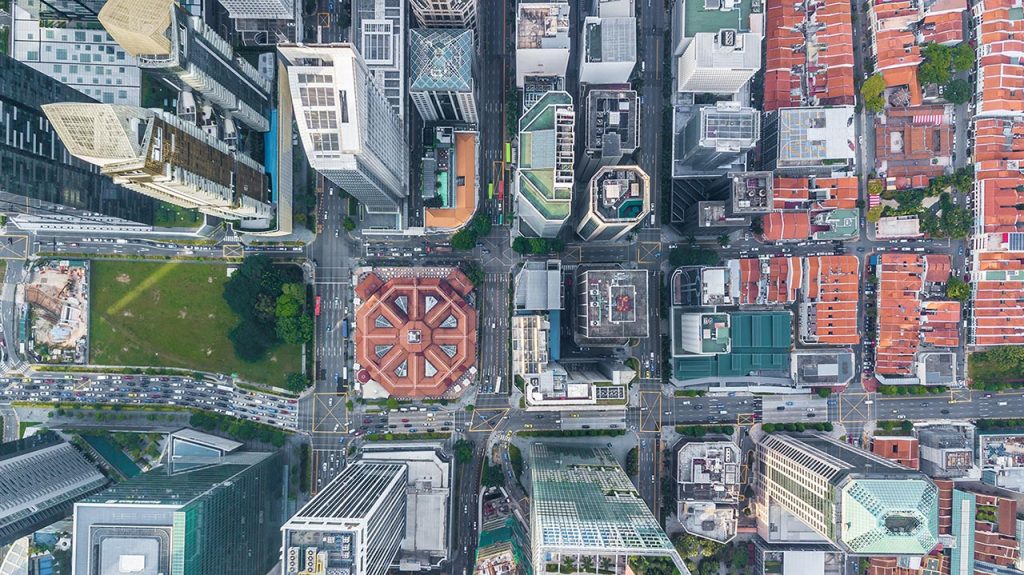

VMware deploys Measurabl as its single source of ESG truth for tracking built environment sustainability projects across locations around the world.

Capital Markets is a new Measurabl line of business begun in 2019 that focuses on providing high quality, auditable, ESG data on commercial real estate assets to financial service providers. It’s driven by increasing interest in and demand for ESG data from commercial real estate investors, lenders, insurers and ratings providers

Measurabl as a tool to capture, track, analyze, benchmark and report on the environmental impacts of properties can support:

VMware deploys Measurabl as its single source of ESG truth for tracking built environment sustainability projects across locations around the world.

Measurabl is founding partner of the GRESB data quality initiative to define guidelines for high quality ESG data and increase investor confidence.

Measurabl has supplied automated utility data transfer and a central place for project metrics to track sustainability data at Salesforce Tower.