Investors are increasingly using ESG frameworks like GRESB (formerly the Global Real Estate Sustainability Benchmark) to inform their decisions. GRESB helps real estate investors assess the ESG performance of commercial real estate portfolios around the globe. Real estate firms that report to GRESB receive a benchmark report that can help them engage with investors and understand how they perform relative to their peers.

The 2022 GRESB assessment saw the greatest amount of participation yet, with 1,820 entities reporting worldwide, representing US $6.9 trillion of gross asset value across 74 countries. Participation by funds in the Americas grew by 30% in 2022, and GRESB saw a 21% increase in funds from the Asia-Pacific (APAC) region.

Though it’s a worthwhile exercise, reporting to GRESB can be tedious, manually intensive, and time-consuming. Accuracy is paramount, but manually inputting required information can result in human error. As a GRESB Global Partner, Measurabl helps hundreds of customers each year quickly and seamlessly report to GRESB, improving data quality while saving substantial time and resources.

Through the Measurabl platform, customers can submit a GRESB Real Estate Assessment and benefit from automated data collection, step-by-step guidance, data integrity monitoring, automated response checks, and other tools to help them complete assessments quickly and accurately.

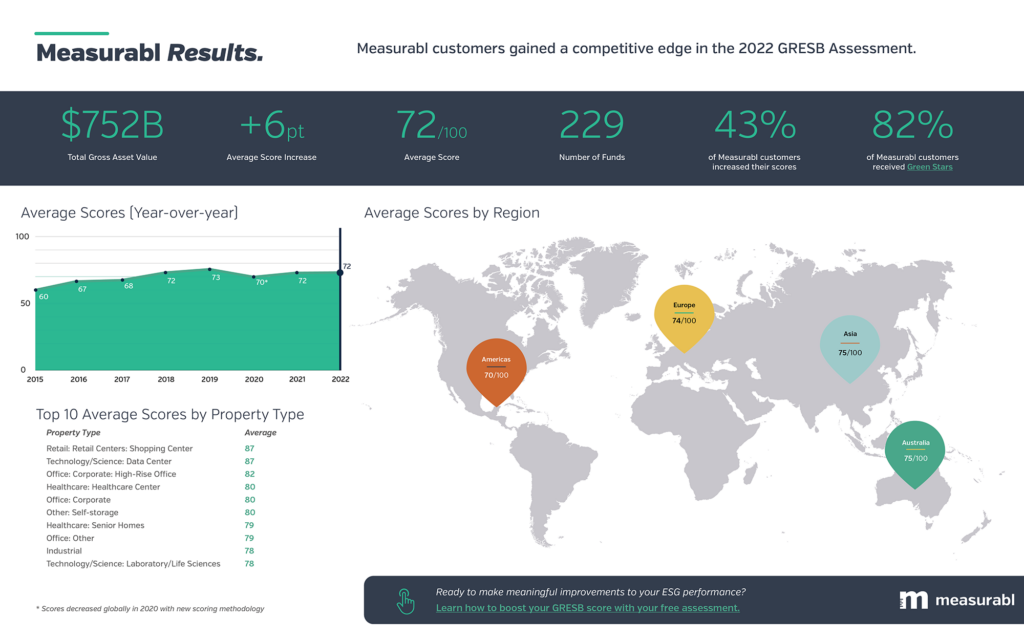

In 2022, our customers scored an average of six points higher than they did in 2021. See more details below on how our customers performed worldwide in 2022.

Need help understanding your score and advice for improving it next year? Schedule a free consultation with one of our GRESB experts today.