Real Estate Finance in the ESG Era

The pressure to align private sector finance with climate solutions has intensified. Demand from investors, consumers and regulators is driving environmental, social and governance (ESG) considerations. Sustainable finance can facilitate the shift from traditional to sustainable economic and credit activities. Fundamental to its efficient functioning, however, is the verification of sustainable outcomes or positive impact.

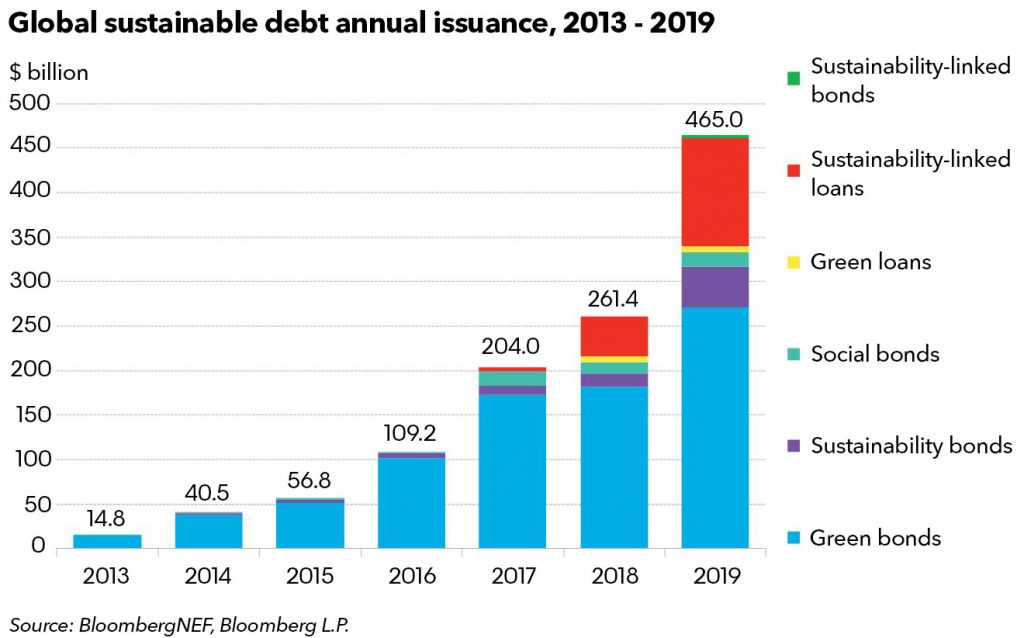

Sustainable finance is growing. According to Bloomberg, the total sustainable debt market—comprised of green bonds, sustainability bonds, social bonds, sustainability-linked bonds, green loans, and sustainability-linked loans—grew 78% year over year, reaching $465 billion in 2019. While green bonds still represent the majority of the total (USD $271 billion or 58%), green and sustainability-linked loans are extending sustainable finance to borrowers that may be unable to raise debt in the capital markets and/or seek more flexible credit structures. An important distinction is that sustainability-linked loans are tied to the overall ESG performance or rating of the borrowing company, and can therefore be used for general corporate purposes. Meanwhile, green loans, like green bonds, tie proceeds to particular projects associated with positive environmental outcomes.

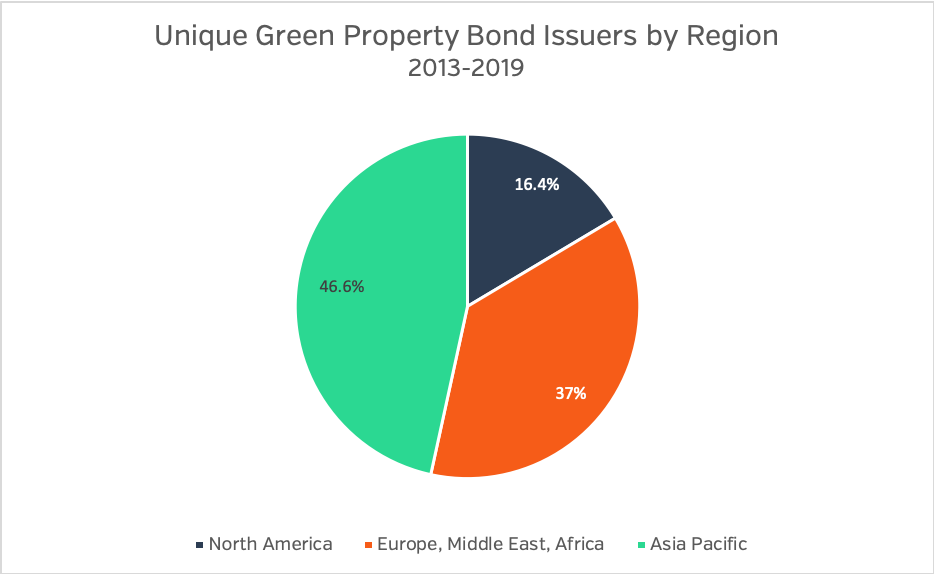

The real estate sector has been well represented in the green bond market. Vasakronan, a Swedish property company, issued the first corporate green bond in 2013. Since then, Measurabl has identified 73 unique green bond issuers from the real estate sector.[1] APAC issuers lead comprising 46.6% of that total, followed by EMEA (37.0%), and North America (16.4%). Listed property companies such as Boston Properties, Inc. (NYSE: BXP), Brookfield Property Partners (NASDAQ: BPY), Digital Realty Trust, Inc. (NYSE: DLR), Prologis, Inc. (NYSE: PLD), and RioCan (TSE: REI.UN)—all Measurabl subscribers—have issued green bonds totalling approximately $5.2 billion within the past two years. Many government-related entities and financial institutions have also issued green bonds and allocated proceeds to green buildings via mortgage loans. CBI reports that 30% of all green bond and loan proceeds were allocated to buildings in 2019.

Growing Demand for Impact Verification and Disclosure

As sustainable finance accelerates, so too will the demand for impact verification and disclosure. The Green Bond Principles (GBP), via its secretariat, ICMA, posted Suggested Impact Reporting Metrics for Green Building Projects in March 2019. The report calls for disclosure on five core indicators: energy, carbon, water, waste, and building certification standard. The specified metrics include intensity level (e.g. use per unit of space), amount or percentage of reduction/savings and percentage of on-site renewables. Spurred by its commitment to achieve the Paris Agreement’s goals, streamline standards, and address concerns about greenwashing, the EU reached agreement on its taxonomy for sustainable economic activities at the end of 2019. It will require such activities comply with ‘robust, science-based technical screening criteria’ as detailed in its Technical Expert Group’s report.

For the real estate sector, this means that in order to be called “sustainable” or “green”, new construction and acquisition activities must apply to buildings with a minimum EPC of “B”. Ultimately, the EU plans to develop absolute energy consumption and GHG emissions levels (operational and embodied) to provide more precise metrics and harmonize nationally-determined energy performance certificate (EPC) and nearly zero energy building (NZEB) levels, which will result in energy demand and GHG emissions in the top 15% of the local building stock. Renovation activities must result in a minimum 30% reduction in energy consumption. Installation of on-site renewables as well as individual renovation measures and other activities that improve building energy efficiency (e.g. LED lighting, smart meters, or building audits) also qualify.

Why does this matter? The rest of the world is looking on as EU legislation establishes standards and best practices likely to be adopted or referenced by other governments, asset managers, asset owners, financial institutions, and corporates, globally. So far, the real estate sector has primarily relied on building certifications (e.g. LEED, BREEAM) for post-issuance reporting, and has not systematically provided impact metrics in line with either the GBP’s suggestions or the EU taxonomy. This trend continues as the market moves beyond certification as a proxy for green. The most commonly cited reason for not opting to issue green debt is lack of data and additional costs and resources required to collect and report impact metrics.

Leveraging Innovation and Technology to Verify and Disclose Environmental Impacts

Software can empower corporate borrowers, underwriters, and lenders/investors to unlock the value of ESG. A data management system (DMS) serves as a centralized repository for the collection and monitoring of actual building performance data. When DMS software is designed with automated data collection, data integrity, and streamlined reporting functionality aligned with market standards, it can not only facilitate operational performance improvement but also support impact fund management and accelerate green financing activities. By removing data aggregation as an impediment and creating consistency and comparability around reported data, issuing, underwriting, and lending via green bonds and other sustainable debt products becomes a viable and scalable option.

The need for actionable, investment-grade quality, environmental impact data is clear. Yet inputting, tracking, and disclosing this information manually without a tech-founded solution at hand can prove next to impossible. Measurabl’s ESG data management software serves as a central repository for the collection and monitoring of asset-level performance data. Measurabl’s automated data collection, data integrity, and streamlined reporting functionalities result in a platform that not only facilitates operational performance improvement but also supports impact fund management and accelerates green financing activities.

Measurabl for sustainable debt underwriters:

- Assures that issuer/borrower has the data collection, tracking and reporting capabilities to support green debt issuance

- Provides flexible currency, space and impact units of measurement to serve not only diverse issuers and portfolios, but also global investor preferences

- Establishes best practice preparedness for evolving, real estate-related, impact reporting recommendations and requirements

Measurabl for lenders and ratings agencies:

- Tracks relevant building ordinances/regulations for every asset on the platform within the U.S., inferring potential contingent liabilities where penalties are assessed

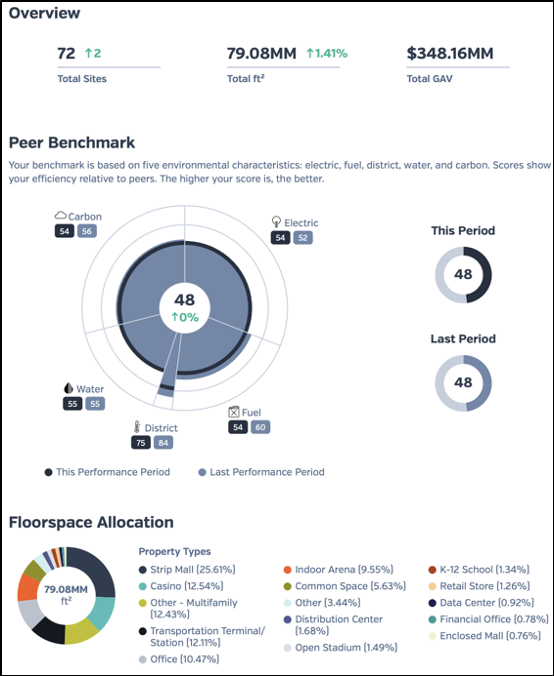

- Provides insight into the environmental performance of an individual asset and/or a borrower’s entire portfolio, relative to peers (based on actual energy, carbon, water, and waste metrics)

- Automatically populates LEED and BREEAM building certification and provides for data entry and tracking for all other building certifications

- Enables flexible target-setting and tracking on energy, water, waste and carbon that can facilitate portfolio or institution-wide ESG goal-setting and monitoring and carbon accounting initiatives

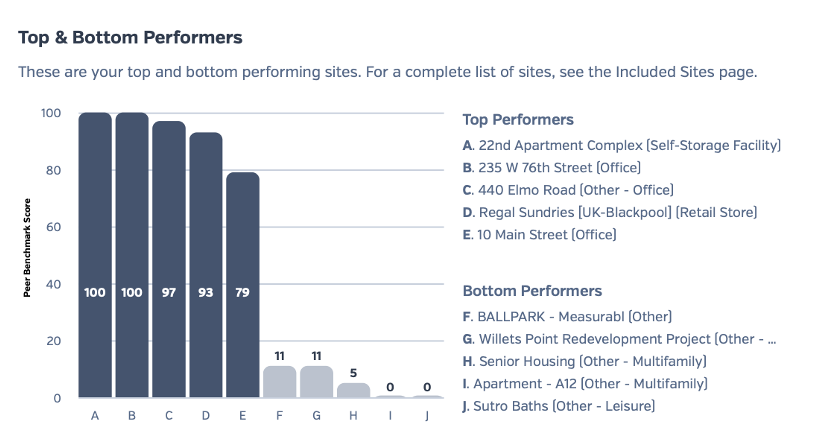

- Generates flexible reports that identify top and bottom performing assets within a portfolio, highlighting risks and opportunities

- Offers gated, multiple user collaboration so that originators, credit and ESG analysts, risk managers and borrowers can contribute information to the platform

Measurabl for real estate owners large and small:

- Automates data collection for energy demand and spend, water usage and spend, waste disposal and spend, and green building certification

- Provides auditable impact metrics pulled directly from utility providers (via utility sync) and backed by digital bills

- Auto calculates location-based carbon emissions and allows for market-based data entry where relevant

- Serves as a centralized repository for all building projects and audits

- Enables customizable target-setting and tracking on energy, water, waste and carbon, based on intensity or absolute levels

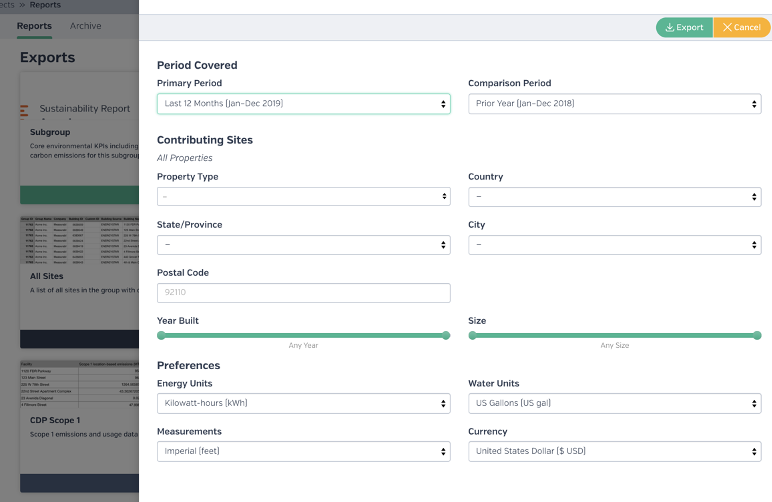

- Generates customizable reports based on user-selected time periods and comparison periods

- Offers gated, multiple user collaboration so that asset managers and property/facilities managers can contribute information to the platform

How to use Measurabl to verify, track and report impact

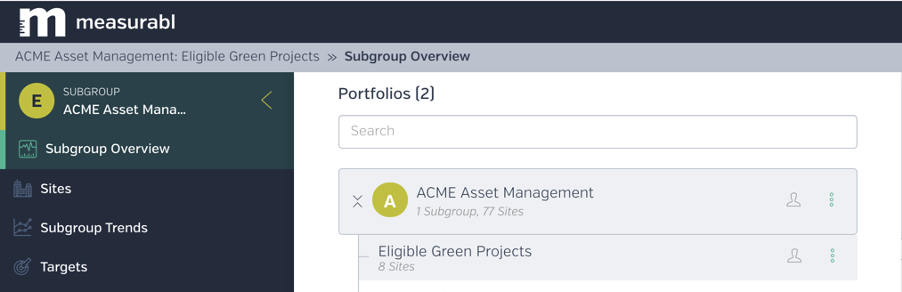

Load sites (buildings) into the platform and organize them by creating as many groups and sub-groups as desired. In the example below, eight of the seventy-seven sites or buildings within the ACME Asset Management group are selected for inclusion in the Eligible Green Projects sub-group. This sub-group could represent assets selected for an impact fund, buildings that have been allocated green bond proceeds or collateral for green or sustainability-linked loans.

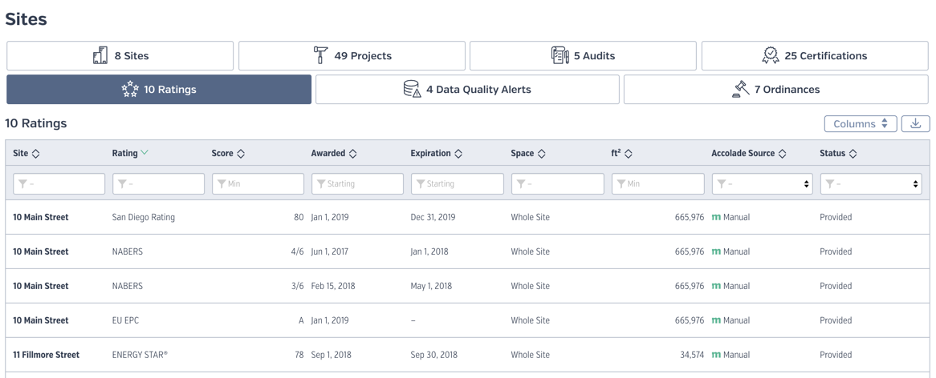

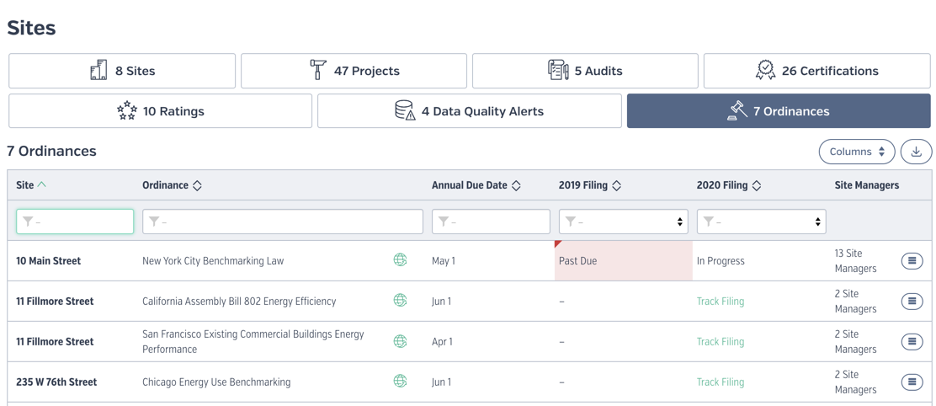

Track asset-level certifications, ratings, ordinances, projects and audits. For example, building ratings include EPCs, Energy Star or NABERS scores.

Ordinances cover local, U.S. regulations such as the New York City Benchmarking Law and California Assembly Bill 802 Energy Efficiency.

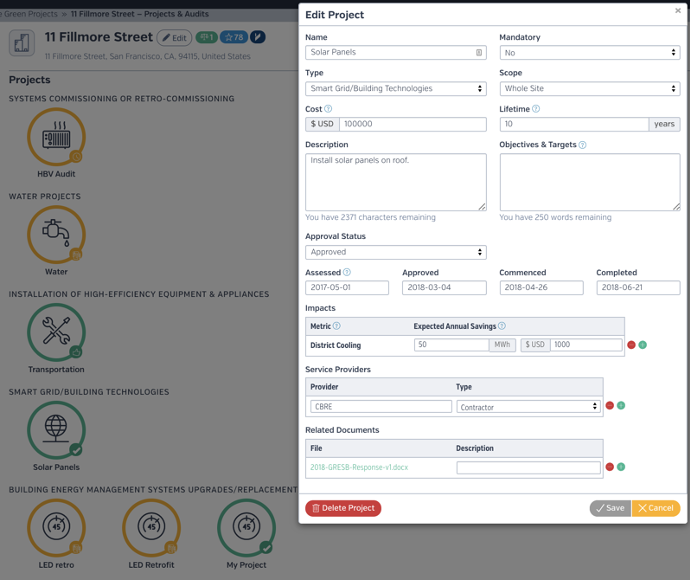

Projects range from installation of on-site renewable energy to water projects and occupier (tenant) engagement. Unlike certifications, ratings, and ordinances, projects are manually entered by real estate owners (or their property managers). Project costs, expected savings, can be entered and tracked in a centralized location across all projects, assets and portfolios.

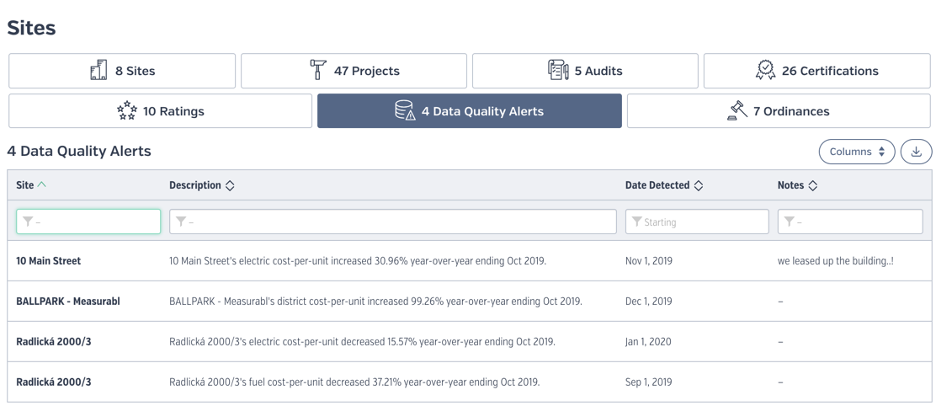

Improving data quality is a key objective for Measurabl. Alerts related to outlier detection and other data integrity issues prompt users to investigate and resolve potential errors.

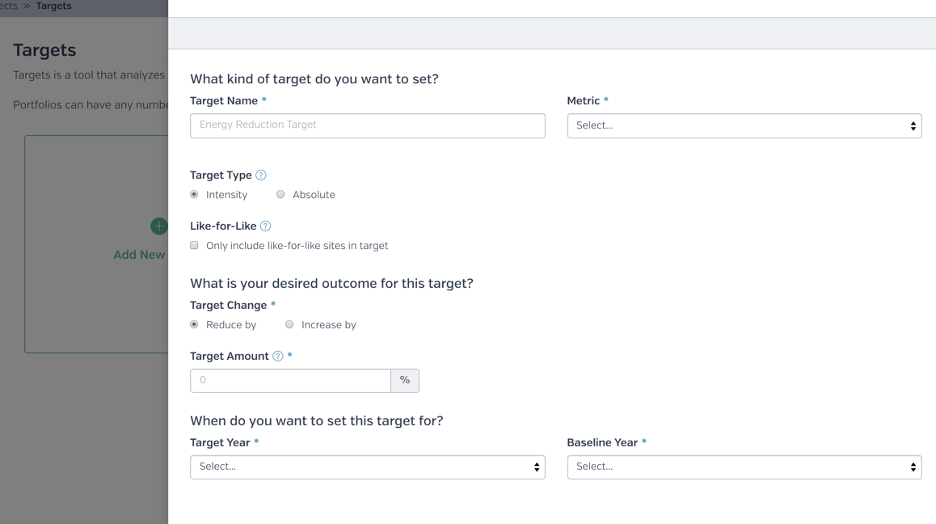

Target setting and tracking is a powerful tool within the Measurabl app. Targets can be set using core real estate environmental metrics, i.e., energy, carbon, water and waste; intensity or absolute levels; and customizable target and baseline years.

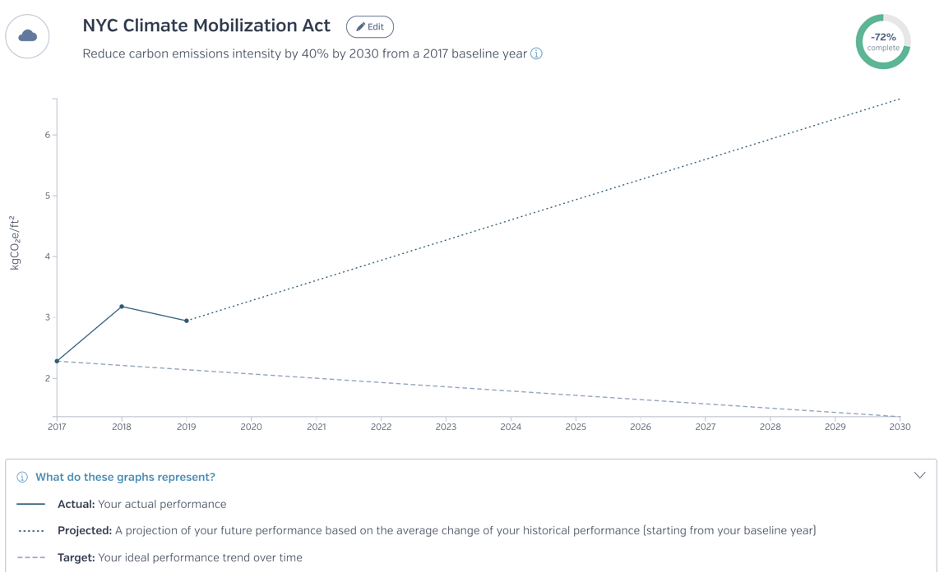

The example below references New York City’s Climate Mobilization Act, which requires buildings that are 25,000 sq. ft. or larger to reduce their carbon emissions (relative to 2005 levels) by 40% by 2030 and 80% by 2050. In the example below, the building has reduced its emissions from 2017 to 2018, but the average performance trend implies a carbon intensity of 6.6 kg CO2e/ft2 by 2030 vs. the 1.4 CO2e/ft2 target, falling far short of regulatory compliance.

The reports tool within the Measurabl app allows for the creation and export of a flexible sustainability report suitable for internal review and decision-making as well as provision to external stakeholders, e.g. lenders, bondholders, investors (LPs), NGOs or the general public.

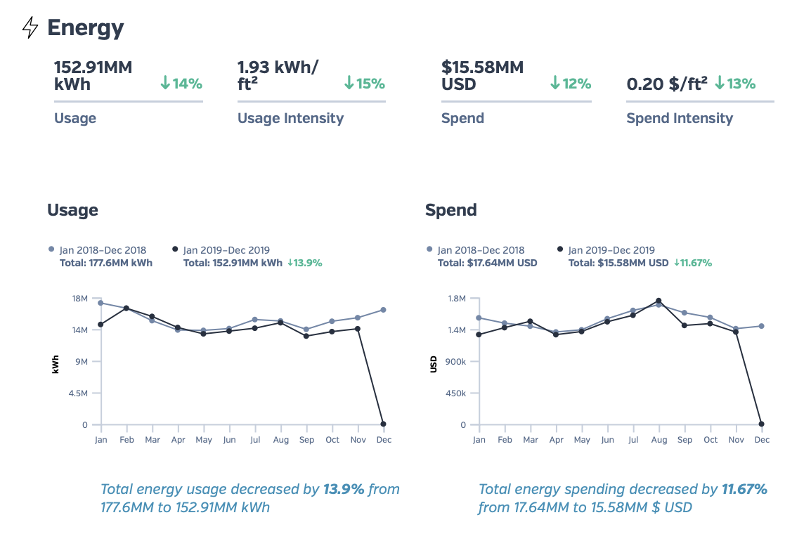

Usage and spend (absolute and intensities) relative to a comparison period, as well as the top and bottom five performing assets, are detailed in the performance (overview) page for each energy, water and carbon. The graphic below is an example of the energy performance page for a selected group of assets.

[1] This figure excludes government-related entities and financial institutions.

Sources

https://www.iflr.com/Article/3893838/Critical-challenges-facing-the-green-bond-market.html

https://www.climatebonds.net/files/reports/cbi_post-issuance-reporting_032019_web.pdf

https://www.climatebonds.net/bond-library

https://about.bnef.com/blog/sustainable-debt-joins-the-trillion-dollar-club/

https://www.environmental-finance.com/content/news/selected-green-and-sustainability-loans.html

About the Author

Sara Anzinger is Measurabl’s Senior Vice President of Capital Markets. Before joining Measurabl, Sara drove the development and implementation of Fitch’s Sustainable Finance initiative in the Americas, and served as Managing Director of Real Estate Debt and Fixed Income at GRESB, where she developed the GRESB Debt Assessment and led the Green Bond Working Group. Sara has worked for Royal Bank of Canada and PNC Bank and spent much of her career in commercial real estate banking and structured finance. She holds a B.A. in Economics from Rollins College and an MSc in International Finance from the University of Amsterdam.