Physical Climate Risk Exposure (PCRX) feature gives Measurabl access to Four Twenty Seven’s data on climate-related risks to inform investment and asset management strategies.

June 1, 2020 – Measurabl, the world’s most widely adopted ESG software for commercial real estate, today releases new feature Physical Climate Risk Exposure (PCRX), a tool to analyze physical climate risk data in its investment grade ESG (environmental, social, governance) data hub. Through an initial integration with Four Twenty Seven, an affiliate of Moody’s and a leading publisher of data and analysis related to physical climate and environmental risks, Measurabl customers can now understand their physical climate risks and opportunities to build resilience across their real estate portfolio.

As the effects of climate change worsen, real estate companies are feeling tangible impacts. Properties exposed to rising sea levels rise in the United States sell at about 7% less compared with similar, unexposed properties. Severe climate events such as hurricanes are occurring more frequently and costing billions of dollars in damage to assets. Additionally, growing pressures to disclose climate-related financial risks are compounded by the growth of popular frameworks like the Task Force on Climate-related Financial Disclosure (TCFD).

Yet today, real estate owners and lenders lack transparency into the looming impacts of climate-related threats on their assets and find it difficult to collect and analyze physical climate risk data in a meaningful, comprehensive way.

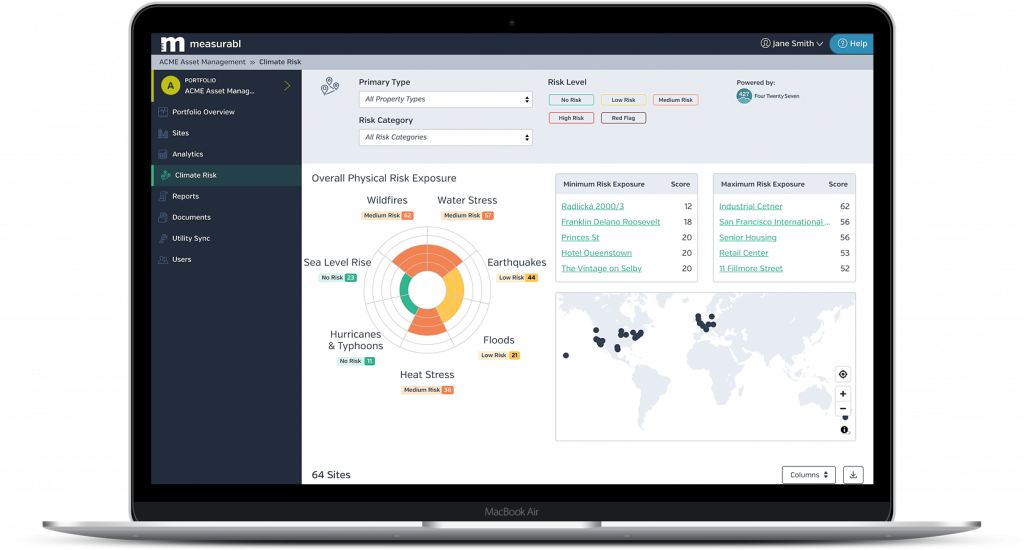

For each building in a portfolio, PCRX provides risk analysis on Measurabl’s platform for key climate and geographic hazards, including wildfires, floods, heat stress, hurricanes & typhoons, sea level rise, water stress, and earthquakes. All of this information is accessed from Measurabl’s centralized software alongside relevant ESG performance metrics and analytics. With this new release, physical climate risks become transparent, and commercial lenders and insurers can use this information to better underwrite risk.

Measurabl displays the level of risk for each asset, making it easy to understand a building’s direct exposure for all six categories. Measurabl’s new feature also allows users to sort, filter, and export Four Twenty Seven’s physical risk data by property type, risk category, and risk level, clearly showing portfolio managers their assets with the highest and lowest risk.

“We’re thrilled to partner with the leading ESG data management platform to provide unprecedented levels of transparency to real estate owners and managers worldwide,” said Emilie Mazzacurati, Founder and Chief Executive Officer of Four Twenty Seven. “As climate change increasingly causes financial damage to real assets, this partnership helps fill the urgent demand for data to help the real estate industry prepare for the impacts of climate change.”

Physical climate risk data analyzed in tandem with ESG performance provides real estate and capital markets new opportunities to assess their risks and build more resilient portfolios in a central hub. Through advanced understanding of these risks, the built environment and capital markets will be empowered to make data-driven decisions on risk mitigation and strategic investments.

“Climate risks are material to how real estate owners, lenders, and insurers underwrite deals,” said Matt Ellis, Measurabl’s CEO. “So integrating it into other ESG metrics gives our customers maximum context when evaluating a transaction’s overall risk-reward profile, leading to better decisions.”

To learn more about the physical climate risks your assets may face and what you can do to prepare, watch our webinar with experts from Measurabl and Four Twenty Seven.